In a recent Gallup survey, respondents ranked different professions according to perceptions of honesty and ethical standards. Nurses hit the top of the list, and dead last were car salespeople — ranking even behind members of Congress. Although few Americans know precisely what percentage of a vehicle’s costs originates at the car dealership, many are inherently skeptical of the industry and sense they are getting a raw deal. And they’re not wrong. In fact, 30 percent of the average American car’s cost has nothing to do with the production of the car itself; rather, it’s additional markups and dealership fees that dig into customers’ pockets. In light of the industry’s clear failure to gain consumer trust and keep prices low, franchised car dealerships may very well be an outdated model for the automobile industry.

The franchising of car sales dates back to when William E. Metzger purchased the right to sell General Motors’ (GM) steam engine in 1898. The agreement was beneficial to both parties: It allowed the manufacturer to spread its reach quickly, with little corporate investment, and it allowed the franchiser to invest in a promising market. Individual franchises also knew their local geographic markets well, giving them an advantage over the manufacturer. Today, when more than 95 percent of households own a car and 85 percent use their cars to get to work, almost 60 percent of car purchases happen in dealerships.

As the car dealership industry grew, the government stepped in with regulations. The most important product of these efforts was quantity forcing, a requirement that dealerships purchase a minimum number of cars from manufacturers. Binding the quantity of inventory meant that exclusive franchises could not use their market power to sell only a handful of cars at exorbitant prices. This law was a wise one: Without quantity forcing, not only would consumers suffer, but manufacturers would also be unable to move their cars from factories to customers.

Nonetheless, regulations like quantity forcing are now few and far between due to dealerships’ outsized influence on local governments. Since Metzger’s first franchise broke onto the scene over a century ago, dealerships’ influence has grown exponentially. The National Automobile Dealership Association (NADA) reports that dealership franchises now employ more than one million people — or between 7 and 8 percent of all retail employees in the United States. Dealerships create many local jobs and pay more than 15 percent of state and local sales taxes. The fact that the Encyclopedia of Interest Groups and Lobbyists in the United States suggests that NADA is the largest donor to local political elections points to why recent regulations have come down decisively on the side of dealerships.

Today, dealerships’ high profits and survival rates are nearly guaranteed. Many states have made it almost impossible for manufacturers to terminate their relationships with dealerships, regardless of dealership performance, and franchises have other protections that provide them with a reliable stream of business. For example, by 2009, a majority of states had enacted laws that made it illegal for manufacturers to require franchises to purchase more vehicles than the franchise wanted to order. This depleted the effects of the quantity-forcing regulations, which had previously prevented dealerships from exploiting manufacturers and their customers. The measure helps dealerships control the prices of cars and therefore boost their profits. Furthermore, many dealerships have pushed through legislation to protect their exclusivity, giving them guaranteed territory in which they can sell their products. The pervasiveness of such legislation is astounding. In 1979, fewer than half of states had implemented the aforementioned rules. By 2014 — 40 years and 30 legislative bills later — all but one state had adopted some form of the regulations.

For manufacturers, being unable to end partnerships with franchises creates a tricky problem: Their distribution system becomes gridlocked, or fixed into certain existing dealership locations. As a result, manufacturers cannot adapt their distribution strategies as populations migrate and expand or as manufacturer market shares fluctuate. Moving distribution requires a new relationship with a dealership, but that’s also an additional cost, as manufacturers face an uphill battle cutting supplies off from dealerships in areas they no longer prefer. Market shares of the “Big Three” — GM, Ford Motor Company, and Fiat Chrysler Automobiles — have fallen in the United States from more than 80 percent to less than 50 percent in the past 40 years. As this has occurred, their dealership networks have remained locked into place, often in locations where the population is no longer concentrated. This has been problematic for the Big Three; the number of cars sold per year per dealership by these manufacturers has fallen to below 400, compared to the more than 1,000 cars per year per dealership that are sold by newer networks selling foreign cars like Hondas and Toyotas. If the Big Three could adapt their dealership networks to the new population centers, rather than relying on locations established in the 1970s and ‘80s, they might see an increase in sales.

The car dealership industry has hurt consumers just as much as manufacturers. Operating costs like salaries, infrastructure, and rent add an extra $2,000 to the sticker price of the average car. Furthermore, in certain states legislation has driven costs up even higher by requiring manufacturers to reimburse dealerships’ repair costs for warrantied vehicles. As a result, dealerships have inflated the price of repairs to amounts that would normally be unsustainable for regular consumers, allowing them to receive substantial payments from manufacturers, who have no choice but to flash the cash. This also hurts customers because, as soon as warranties expire, they find themselves footing a ridiculous bill.

NADA doesn’t just out-influence car manufacturers in the legislative process; it also often overrides public opinion. Tesla, for example, has not embraced the dealership model, instead setting up manufacturer-owned locations to manage their own distribution. When the company made a push for the right to establish sales centers in Texas, a survey by Austin Business Journal showed that 86 percent of readers supported the company’s proposition. However, traditional dealerships, unhappy at the prospect of losing business, strong-armed local policymakers into thrusting new regulations upon Tesla, effectively preventing the company from establishing its manufacturer-driven franchises. Four other states have followed suit by banning the direct sales model that Tesla uses. In other states, Tesla stores are available but operate with strict restrictions. Georgia, for example, only allows manufacturer-owned stores to sell 150 cars annually while Colorado has banned Tesla from building new stores, limiting the company to the single location it built before the ruling disrupted its distribution plans.

Though NADA and its associates claim to promote competition, simplify the car-purchasing experience, and boost local economies, their business practices effectively do the opposite. It’s true that dealerships see small margins on the sale of new cars, and NADA stresses that this means dealerships aren’t hurting consumers. However, the small margins are irrelevant to dealerships’ real sources of profit, which include financing, trade-ins, and repairs. NADA also claims that if dealerships were eliminated, manufacturers would have to take on the costs of owning car lots and hiring salesmen. But this argument rests on the premise that this infrastructure is necessary. It isn’t. Consider GM’s sales of the Chevrolet Celta in Brazil, where the company owns limited showrooms, each with one vehicle for test-driving and one for examining. Those who like what they see can then order the car online with various options and have it delivered straight from one of a few factories. Despite having comparatively little physical infrastructure, GM of Brazil has had great success with this model: The Celta was named the best online selling vehicle in the world, and in 2010, it was the third-most popular car in Brazil.

In fact, such alternative distribution models are actually preferable for consumers. A recent survey found that about 75 percent of respondents said that, given the option, they would consider purchasing a car and handling all the financing, negotiating, and paperwork involved in that process online, rather than in person at a dealership. This data is in line with Time magazine’s description of the consumer experience at a dealership as a “confusing, high-pressure, [and] unreasonably long process.” There’s a reason dealerships are stigmatized: They’re rarely enjoyable experiences. This reality, however, is a stark contrast to NADA’s claim that “dealers just make things convenient.”

It’s true that dealerships do provide some utility to consumers. Trade-ins are still less time-consuming for customers than selling their own vehicles. Dealerships also provide about one-third of maintenance work done in the United States, with the rest primarily going to independent mechanics. And for some, the convenience of driving a car off the lot after just a few hours of paperwork and negotiating beats the potential week-long delivery process that online distribution would necessitate.

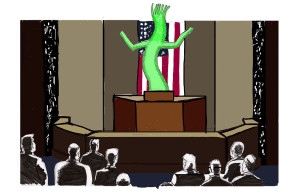

Since the advent of online shopping over the past two decades, people’s perceptions of purchases have changed. Shopping now consists of Googling for cost comparisons, reading up on specifications, and, after adequate self-education, pushing the checkout button. While this is what customers say they want, and this system is similar to what automaker Tesla now uses, it’s not clear that it’s the best option for manufacturers or customers. Even Elon Musk, Tesla’s CEO, has discussed the possibility of opening up dealer franchises alongside Tesla-owned stores, as the company expands; even a small showroom’s costs can add up when a company wants to reach the entire United States. But right now, market exploration can’t even begin to occur, because dealerships, with their outsized political power, have a stranglehold on the process. Even if dealerships ultimately do have some upsides, it’s hard to blame consumers for trusting them even less than they trust Congress.

Art By: Justin Johnson